consumerfinance.gov

Consumer Financial Protection Bureau "CFPB"

TMBTX Financial started working with state licensed small and medium size Credit Services Organizations (CSO's) in early 2015 in Texas, and shortly thereafter in Ohio. We provide the best value in the industry for cash advances, title loans, payday and installment loans for major CSO. We are committed to being fully compliant with federal law, we believe in the highest standards of conduct, and we are dedicated to ensuring the best possible experience for our customers.

Best value in the industry

Cash Advances, Title Loans, Payday

Best customer experience

TMBTX Financial specializes in analyzing your business to help optimize your cost structure, providing you more flexibility to redeploy resources in other high growth areas of focus. These savings can be used to improve the customer experience, increase retention and ultimately result in a higher profitability.

We provide a forum for our customers to share industry best practices with each other. We work with you to open up new opportunities to enhance your operational setup thru relationships with lead generation companies, banking relationships, collection agencies, and even industry specific legal firms.

Ohio represents one of the best markets in the country for consumer finance as it has a population of over 11M and is one of the most regulated markets in the country. There is only a handful of state licensed CSO's in Ohio as compared with other states.

The Ohio model requires that CSO's to operate alongside the Third Party Lender who provides the funds for loans to consumers and is responsible for the servicing of the loan. The Ohio CSO model and Texas CAB model are very similar. The main difference is the Ohio requirement of the Third Party Lender to directly service the customer once the loan has been approved. In Texas, the CAB manages 99% of the process.

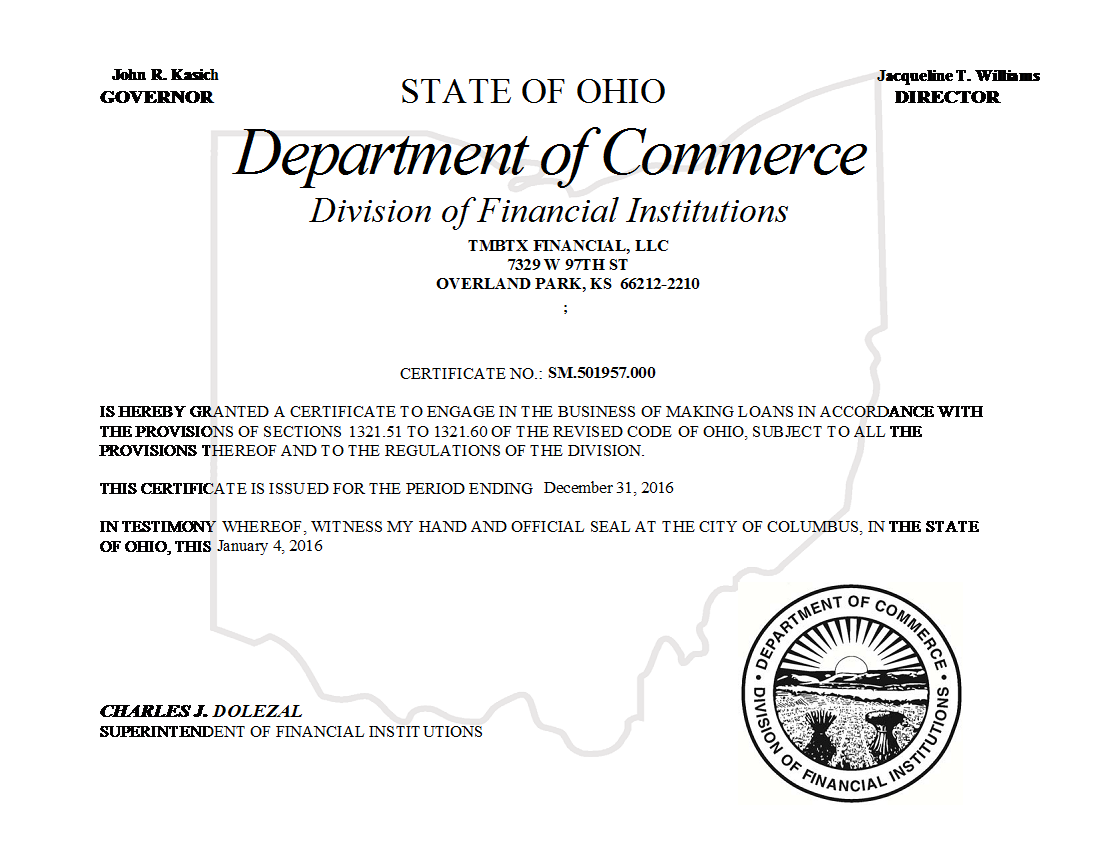

TMBTX Financial has been licensed in Ohio since early 2016. If you are interested in potentially changing your current Third Party Lender setup in Ohio, we would like the opportunity to discuss how we might be able to improve your experience. We are in the process of assisting several CSO's obtain their Ohio license, and would very much like to hear from you if you are in the planning process of opening a CSO soon.

Texas is the premier market in the country for consumer lending with a population of almost 27M. The Texas model requires that CSO's, and Credit Access Businesses (CAB's) operate alongside the Third Party Lender who provides the funds for loans to consumers.

TMBTX Financial has been operating as a Third Party Lender in Texas since early 2015. If you are interested in potentially changing your current Third Party Lender setup in Texas, we would like the opportunity to discuss how we might be able to improve your experience and save you/your customers a significant amount of interest/fees as compared to our competition.

We have multiple clients in Texas representing cash advances, title loans, payday and installment loans for small & medium size CSO's.